philadelphia wage tax for non residents

For residents of Philadelphia or 34481 for non-residents. On the other hand if a Philadelphia employer requires a non-resident to perform duties outside the city he or she is exempt from the Wage Tax for the days spent fulfilling that work.

City Of Philadelphia Announces Wage Tax Rate Increase For Non Residents Starting July 1 2020 Wouch Maloney Cpas Business Advisors

The new rates are as follows.

. A non-resident who works from home for the sake of convenience is not exempt from the Wage Tax even with his or her employers authorization. The new rates are as follows. Non-residents who work in Philadelphia must also pay the City Wage Tax.

Non-resident employees who work for Philadelphia-based employers are not subject to Philadelphia Wage Tax during the time they are required to work outside of Philadelphia. Philadelphia residents are subject to the wage tax at a rate of 38712 no matter where they work. The tax has often been cited as a job killer but it raises so much money that the city cant easily replace it.

The July 1 st city wage tax increase will take effect the same week that Philadelphia moves into the green phase for businesses to reopen. Nonresident Earnings Tax rates will be reduced to 34481 percent down from the previous rate of 35019 percent and resident Earnings Tax rates will be reduced from the previous rate of 38712 percent to 38398 percent effective July 1 2021 according to an announcement by the City of Philadelphia. Any non-resident employee who is REQUIRED to work remotely outside of the city because of the pandemic is not subject to the wage tax during that.

All Philadelphia residents owe the City Wage Tax regardless of where they work. Wage Tax policy guidance for non-resident employees. On the other hand if a Philadelphia employer requires a non-resident to perform duties outside the city he or she is exempt from the Wage Tax for the days spent fulfilling that work.

For help getting started and answers to common questions you can see our online tax center guide. City residents have to pay 38712 and non-residents who work in the city owe 35019 2020 tax year. Philadelphia has the nations highest wage tax currently 387 for residents and 35 for nonresidents who commute to work in the city.

City residents have to pay 38712 and non-residents who work in the city owe 35019 2020 tax year. Be certain your payroll systems are updated to reflect the increased non-resident tax rate. Before COVID-19 companies withheld Philadelphia wage tax from paychecks automatically.

City of Philadelphia Wage Tax This is a tax on salaries wages and other compensation. Beginning on July 1 2021 the City of Philadelphia will lower the rates of its Wage Tax and Earnings Tax for both resident and non-resident taxpayers alike. Nonresidents who work in Philadelphia pay a local income tax of 350 which is 043 lower than the local income tax paid by residents.

The City of Philadelphia announced that effective July 1 2021 the Earnings Tax rate for nonresidents is 34481 down from 35019 and the rate for residents is 38398 a decrease from the previous rate of 38712. Residents of Philadelphia pay a flat city income tax of 393 on earned income in addition to the Pennsylvania income tax and the Federal income tax. Starting in 2022 you must complete returns and payments for this tax only electronically on the Philadelphia Tax Center.

A non-resident employee who works from home for his or her convenience is not exempt from the Wage Tax even with his or her employers authorization. PHILADELPHIA WPVI -- So many people are working from home during the pandemic and that could impact your taxes. Tax rate for nonresidents who work in Philadelphia.

The Philadelphia Department of Revenue has not changed its Wage Tax policy during the COVID-19 pandemic. Beginning on July 1 2021 the City of Philadelphia will lower the rates of its Wage Tax and Earnings Tax for both resident and non-resident taxpayers alike. During the pandemic the City of Philadelphia did not change its position regarding the wage tax.

People who live in the city no matter where they work must always pay the 38712 resident wage tax. On the other hand if Philadelphia. Under this standard a nonresident employee is not subject to the Wage Tax when the employer requires him or her to perform a job outside of Philadelphia ie.

In the state of California the new Wage Tax rate is 38398 percent. The wage tax rate for residents of Philadelphia was not increased and remains at 38712 038712. Nonresidents who work from home for their own convenience rather than the need of the employer are not exempt from the Wage Tax even with their employers authorization.

The City Wage Tax for Philadelphia residents is 38712 and 35019 for non-residents. As long as companies are requiring employees to work from home they are exempt from the 34481 nonresident tax. Schedules to withhold and remit.

In the state of California the new Wage Tax rate is 38398 percent.

Philly Workers Who Stayed Home May Be Due A Wage Tax Refund Newtown Township Bucks County Pennsylvania

Philadelphians Who Work Outside Pa Could Be Eligible For Wage Tax Break Whyy

20 Honest Pros Cons Of Living In Philadelphia The Helpful Local

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

Philly Workers Who Stayed Home May Be Due A Wage Tax Refund Newtown Township Bucks County Pennsylvania

Phillydotcom Infographic Infographic Gambling Information Graphics

Philadelphia Cost Of Living 2022 Can You Afford Philadelphia Data

When Are Non Residents Exempt From Philadelphia S Wage Tax Department Of Revenue City Of Philadelphia

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

Philadelphia City Council Members Staff Must Be Vaccinated For Covid 19 By Fall Session 6abc Philadelphia

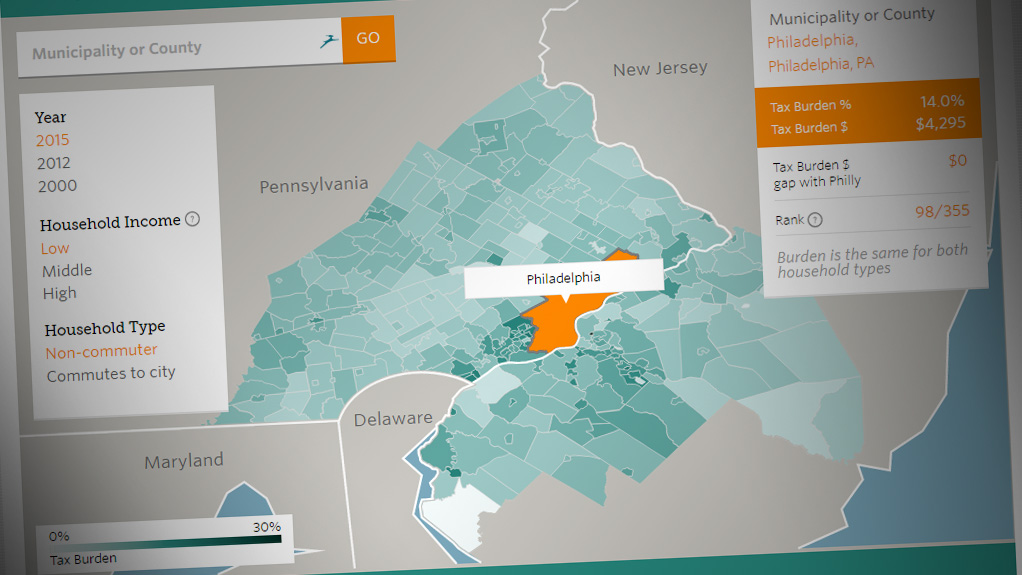

Comparing The Tax Burden In Philadelphia And The Suburbs The Pew Charitable Trusts

There S A New Tax Refund Available In Philadelphia This Year Philadelphia Legal Assistance

Who Pays Wage Tax And When Department Of Revenue City Of Philadelphia

Philly City Council Reviews Pandemic Impact On Finances Whyy

2020 Philadelphia Tax Rates Due Dates And Filing Tips

Philadelphia City Council Unveils 5b Budget Whyy

City Announces Wage Tax Reduction Starting July 1 2017 Department Of Revenue News City Of Philadelphia

Philadelphia Underperforms National Economy Pew Report Says Whyy

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine