schedule c tax form llc

An activity qualifies as a business if. Ad Fillable SCHEDULE C Form 1040.

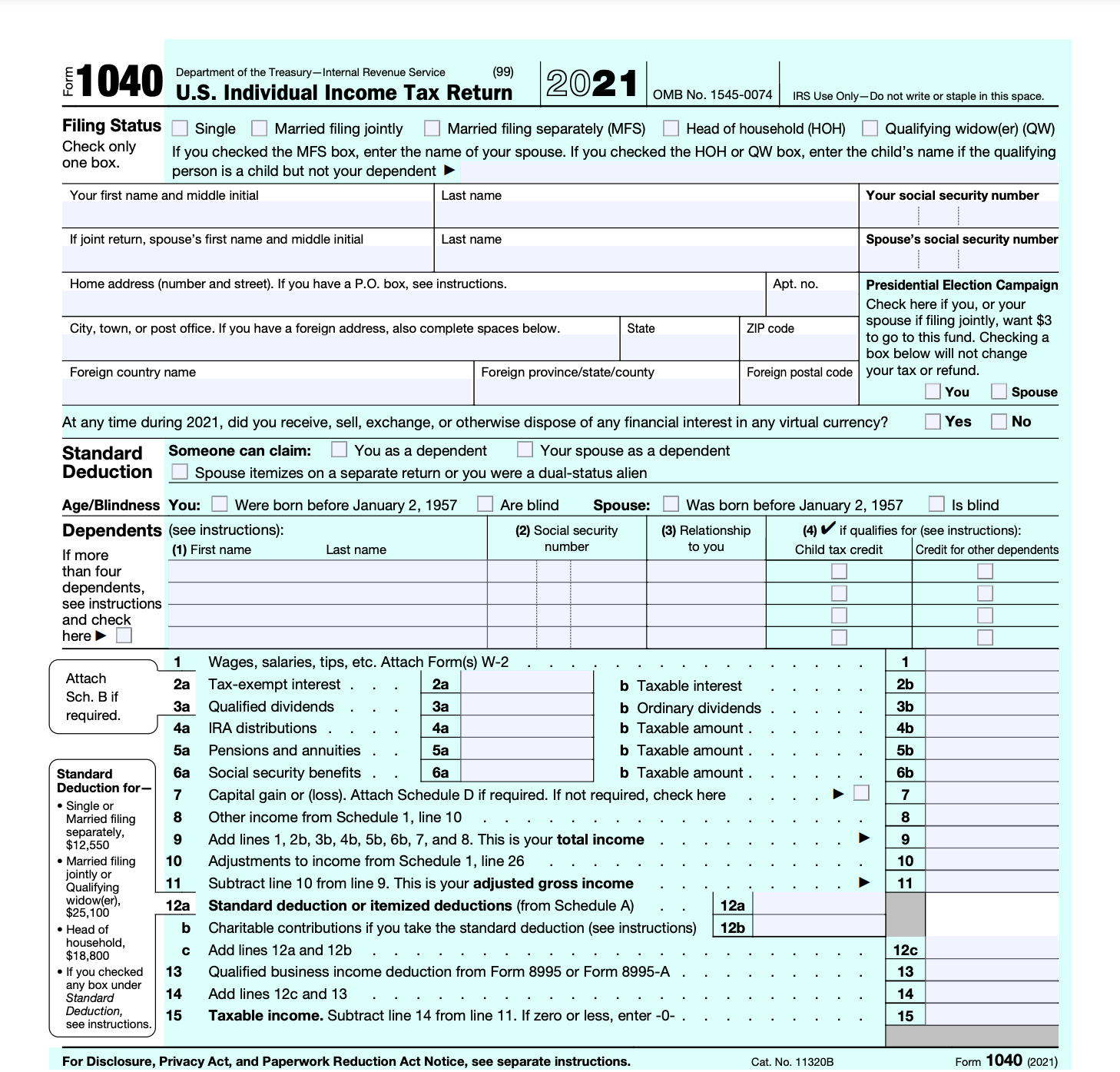

What Is Irs Form 1040 Overview And Instructions Bench Accounting

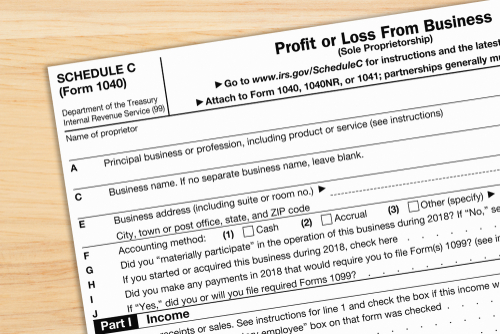

It is a form that sole proprietors single owners of businesses must fill out in the United States when filing.

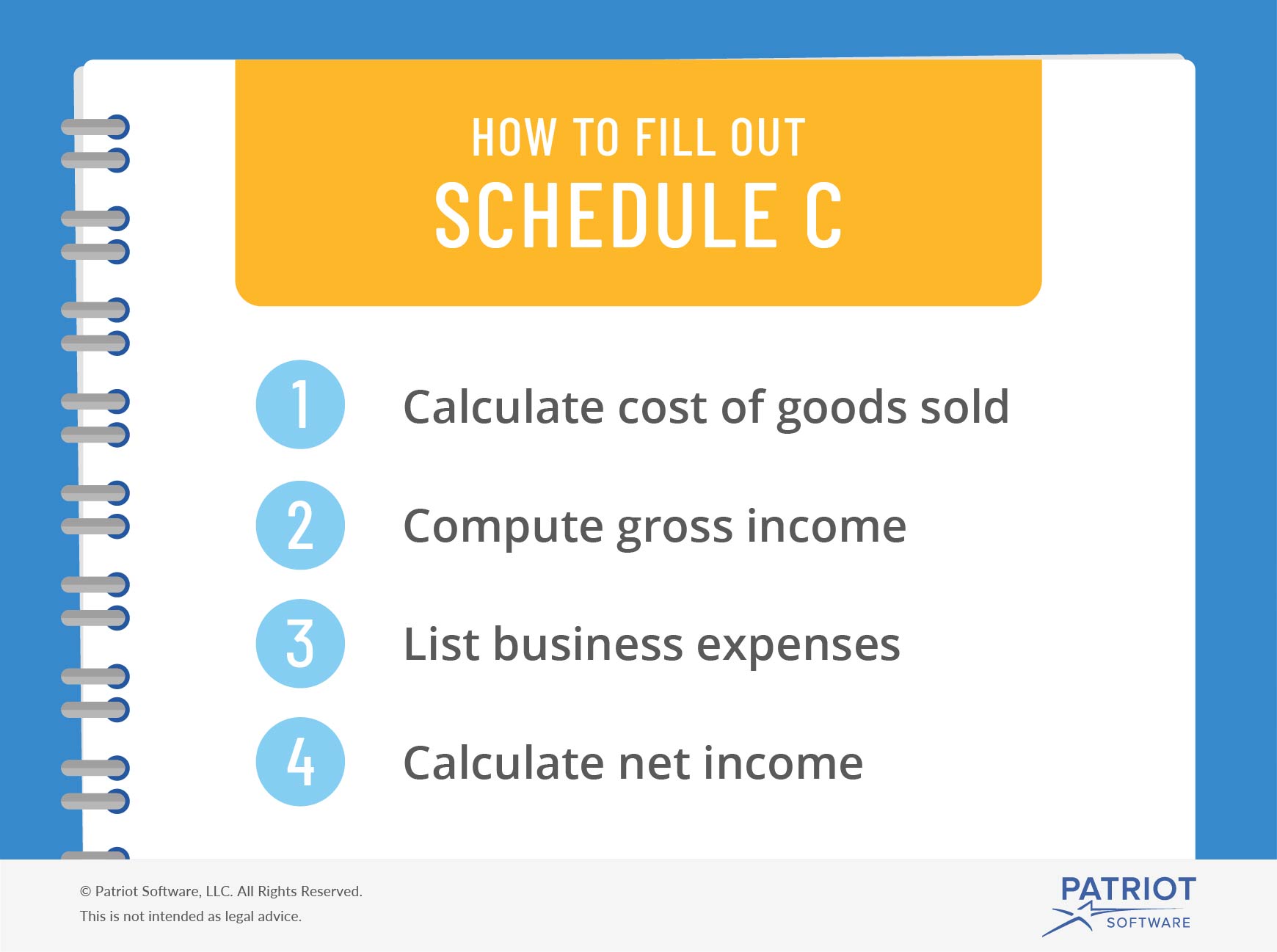

. Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Schedule C is the business tax return used by sole proprietors and single-member LLCs. SCHEDULE C Form 1040 or 1040-SR Department of the Treasury Internal Revenue Service 99 Profit or Loss From Business Sole Proprietorship Go to wwwirsgovScheduleC for.

Profit or Loss From Business Sole Proprietorship is used to report how much money you made or lost in a business you operated by yourself. Schedule C is a tax form for small business owners who are sole proprietors or single-member LLC owners. According to the form you can.

Who Files a Schedule C Tax Form. Your Schedule 1 in turn will calculate. Most people who receive a Form 1099-NEC or Form 1099-K need to file Schedule C.

What is a Schedule C. In the second part of the form deduct your business. Profit or Loss From Business Sole Proprietorship shows how much money you made or lost when you operated your own business.

On this form California has a minimum LLC tax payable to the Franchise Tax Board of 800 per year with no regard for the sales amounts or your net income or loss. If there is more than. At the time of publication however youll report your business profit or loss from line 31 of your C Schedule onto line 3 of your Schedule 1.

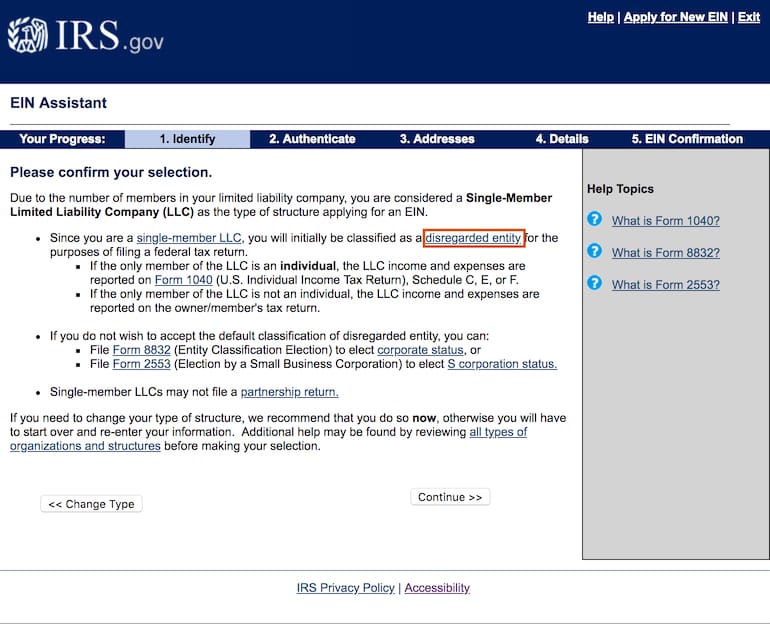

Schedule C is used to report self-employment income on a personal return. SCHEDULE C Form 1040 Department of the Treasury Internal Revenue Service 99 Profit or Loss From Business Sole Proprietorship Go to wwwirsgovScheduleC for instructions and. A single member LLC is disregarded for federal tax purposes and is treated as a sole proprietorship whose owner must file a Schedule C with their Form 1040.

Schedule C Form 1040 is a form attached to your. In the first part you must detail all of your business revenue and work out your gross profit. The Schedule C tax form combines a sole proprietors business income and expenses to determine the net profit reported on Form 1040.

The Schedule C tax form is used to report profit or loss from a business. The form reports how much of. Self-employment income is how we describe all earned income derived from.

Single-member LLCs are a type of LLC with only one owner. Schedule C is also where business owners report their tax-deductible business expenses such as advertising certain car and truck expenses commissions and fees. The Schedule C.

Schedule C Form 1040 is a form attached to your personal tax return that you. There are five sections in a Schedule C form. There is no distinction between the.

Louisiana Department Of Revenue Updates Partnership Reporting Requirements Cooking With Salt

Schedule C What Is It For And Who Has To Fill It Global Tax

How To Single Member Llc Sole Proprietor Taxes Dp

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business

What Is An Irs Schedule C Form

Filing A Schedule C For An Llc H R Block

What Is A Schedule C Filing Requirements More

Sole Proprietorship Taxes Understanding The Schedule C Tax Form Picnic Tax

What Is A Disregarded Entity And How Are They Taxed Ask Gusto

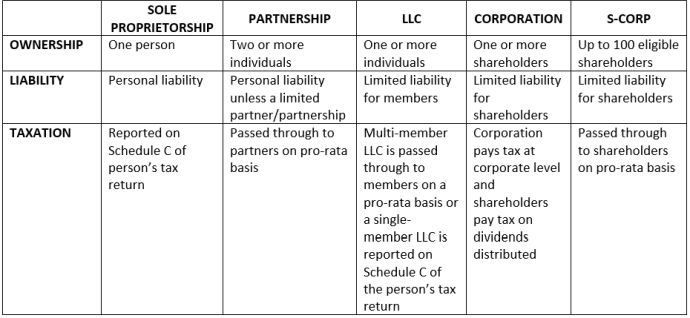

Which Entity Should I Form When Starting A New Business Tax Authorities United States

What Do The Expense Entries On The Schedule C Mean Support

What Is A Schedule C Irs Form Turbotax Tax Tips Videos

How To Fill Out Your Schedule C Perfectly With Examples

Additional Schedule C Wilson Financial Wealth Management And Financial Planning

How To Fill Out An Llc 1065 Irs Tax Form

Tips On Using The Irs Schedule C Lovetoknow

Memo Onlyfans Myystar Creators Business Set Up And Tax Filing Tips Chris Whalen Cpa

Tax Guide For Photographers Fstoppers

Irs Transcript Business Name Screwed Up Could This Be What Is Holding Me Up Invite 2 6 Tax Form 2 24 Request For Dl 3 24 Still Submitted Name Should Read Bash On Wheels Llc