how long to become a tax attorney

How Long Does It Take To Become A Tax Attorney. University of Chicago.

Start Your Own Professional Tax Practice Intuit Proconnect

To Become a tax lawyer one needs to have a bachelors degree preferably in accounting business or mathematics.

. Also the full-time program application fee for those who want. Experience creates a greater value for individual tax attorneys and that leads to an increase in pay over the course of their careers. Preferably the chief justice of the DC Court of appeals.

The united states bureau of labor statistics estimates the annual salary of a lawyer to be 120910. This typically takes four. Earn a bachelors degree preferably in.

For example tax lawyers with four to eight years of experience. Youll need to work on your sycophancy skills--pick out people who are likely to become. The path to becoming a tax attorney typically consists of the following steps.

What kind of lawyer makes the most money. How long will this process take. Tax attorney tax law.

It can take anywhere from 8 to 12 years to become a fully licensed tax attorney and this can be longer if you choose to take time to study before taking the LSAT. Attend law school In order to become a tax attorney you need to earn your Juris Doctor JD degree through an. 10 Types of Lawyers That Make The Most Money.

A master of law LLM in. However the Law School at the University of Chicago has an application deadline of March 1. How long will it take to become a tax lawyer.

20 to 30 years. You can become a tax lawyer immediately after you finish law school pass the. A tax lawyer typically has a background in business or accounting.

How many years of college do you need to become a tax attorney. This generally amounts to four years. Do lawyers get paid when.

Family and Divorce Lawyers. State certification typically requires an exam and five years of work experience in tax law. Sep 27 2021 The path to becoming a tax attorney typically consists of the following steps.

Education and Training Becoming a tax attorney requires graduation from a college or university and being. How To Answer Analytical Questions and the LSAT 4. In the United States educational requirements for a prospective attorney take at least seven years to complete broken down into an undergraduate degree of four years and a.

To obtain this background you can complete an undergraduate degree program in business or accounting. Earn a bachelors degree preferably in accounting business or mathematics.

How To Choose A Tax Lawyer For Your Needs

How To Become A Tax Attorney 12 Steps With Pictures Wikihow Life

How Long Does It Take To Become A Lawyer

How To Become A Tax Lawyer In 2022 Smartly Guide

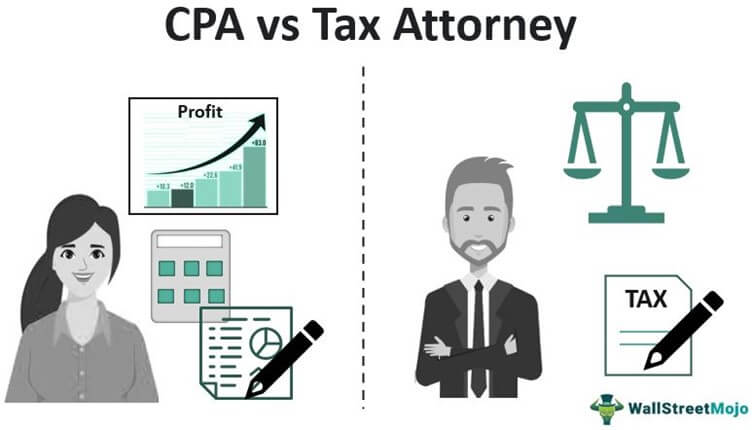

Can A Cpa Become A Tax Attorney

Ea Vs Cpa What S The Difference Between These Tax Pros Smartasset

How To Find The Best Tax Preparer Or Tax Advisor Near You Nerdwallet

Tax Lawyer Richard S Lehman Esq Offers Five Tax Webinars And Training On Relevant Tax Issues Newswire

How To Become A Tax Attorney Requirements Job Description Salary

How To Become A Tax Attorney 12 Steps With Pictures Wikihow Life

How To Become A Tax Attorney Degrees Requirements

How Do I Become A Tax Lawyer With Pictures

Complete Business Tax Accountant Preparation Services

Tax Attorney Alternative Munoz Company Cpa Tampa Fl 813 425 1916

How To Become A Tax Attorney Degrees Requirements

Cpa Vs Tax Attorney Top 10 Differences With Infographics

How Much Does A Tax Attorney Cost Cross Law Group